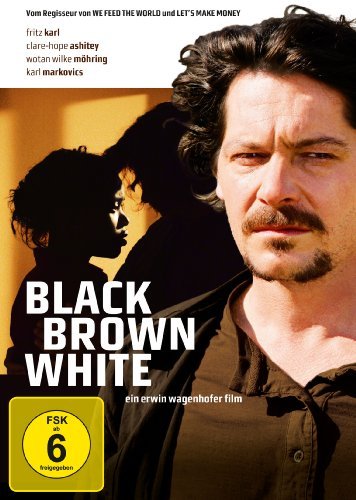

Black Brown White

Der Film „Black Brown White“ ist ein klassisches Roadmovie mit politischem Anstrich und gleichzeitig das österreichische Spielfilmdebüt des Dokumentarfilmers Erwin Wagenhofer. Der Film erzählt von dem Fernfahrer und Schmuggler Don Pedro.

| Dauer: | 102 Min. |

|---|---|

| FSK: | ab 16 Jahren |

| Jahr: | 2011 |

| Regie: | Erwin Wagenhofer |

| Produzenten: | Helmut Grasser |

| Hauptdarsteller: | Fritz Karl, Claire-Hope Ashitey |

| Nebendarsteller: | Juanma Lara, Theo Caleb Chapman, Wotan Wilke Möhring, Francesc Garrido |

| Studio: | Allegro Film |

| Sprachen: | Deutsch, Englisch |

Nachdem dieser eine Gemüselieferung nach Marokko erledigt hat, nimmt er Flüchtlinge auf der Ladefläche seines LKW mit nach Europa. Doch eine junge Frau lässt sich nicht in das Hintere des Lastwagens pferchen. Sie setzt sich zu Don Pedro in die Fahrerkabine. Für diesen beginnt damit eine ungewöhnliche Reise, die ihn für immer verändert.

Besetzung, Regie und Drehorte

Regisseur Erwin Wagenhofer schrieb auch das Drehbuch für „Black Brown White„. In den Hauptrollen sind Fritz Karl (Wer früher stirbt, ist länger tot) als zunächst abgebrühter Fernfahrer Don Pedro und Claire-Hope Ashitey (Children of Men) als flüchtende afrikanische Mutter zu sehen. Karl Markovics (Der Fälscher) brilliert in einer Nebenrolle als zwielichtiger Spediteur Jimmy. In einer weiteren Nebenrolle spielt Wotan Wilke Möhring (Männerherzen) einen „Arzt ohne Grenzen“. Der Film wurde hauptsächlich im südspanischen Andalusien gedreht und kam am 18. Februar 2011 in die Kinos. Hinter der Kamera stand der Veteran Martin Gschlacht (Revanche), der den Film mit intensiven Landschaftsaufnahmen und vielseitiger Bildgestaltung versorgt.

Handlung & Inhalt vom Film „Black Brown White“

Don Pedro heißt eigentlich Peter und kommt aus reichem Elternhaus. Dass er als Fernfahrer sein Geld mit einfacher Lohnarbeit verdient, hat er sich selbst ausgesucht. Was für andere nur „Maloche“ ist, ist aus seiner Perspektive deshalb eine Form von Freiheit. Mit seinem Partner Jimmy betreibt er eine kleine Speditionsfirma. Sein nächster Auftrag ist eine Lieferung von ukrainischem Knoblauch, den er aus Berlin abholt und nach Marokko fährt. Jimmy und Pedro haben aber noch ein illegales Nebengeschäft aufgebaut. Auf den Rückfahrten schmuggelt Pedro nämlich regelmäßig Flüchtlinge nach Europa. Als zynischer Schlepper, dem Geld über so einiges andere geht, verdient er an den Notlagen anderer Menschen.

In Marokko verstecken sich ein halbes Dutzend Flüchtlinge im Hohlraum hinter der Kabine seines LKW. Normalerweise müssen alle Flüchtlinge hinten in den Wagen, um versteckt zu bleiben, aber die junge Jackie ist nicht gewillt, diese Strapazen zu ertragen. Sie hat nämlich ihren kleinen Sohn Theo dabei. Der Vater ist ein UN-Beamter, der in Marokko tätig war aber nach Genf versetzt wurde. Jackie will Theo um jeden Preis zu seinem Vater bringen, damit der sich um eine gute Schulbildung für den Jungen kümmert. Also setzt sie sich zu Pedro in die Fahrerkabine und lässt sich von diesem auch durch aufgeregtes Diskutieren nicht davon abbringen, vorne zu sitzen. Pedro gibt nach und will Jackie mit zur Grenze nehmen aber nicht weiter.

Doch auf der Fahrt dahin lernen die Beiden sich kennen und Jackie ist Pedro schon bald sehr sympathisch. Er bewundert sie auch insgeheim dafür, dass sie bereit ist, sich in Gefahr zu bringen, um ihrem Sohn ein besseres Leben bieten zu können. An der Grenze angekommen, will er ihr deshalb doch helfen, nach Europa zu gelangen. Damit geht Pedro nun selbst ein gewaltiges Risiko ein. Aber dem mit allen Wassern gewaschenen LKW-Fahrer gelingt das Kunststück. Doch auf einem Umladeplatz in Almería im Süden Spaniens ist Theo auf einmal verschwunden. Pedro und Jackie suchen verzweifelt nach ihm, die Polizei wird gerufen und Pedro verliert seine Ladung. Theo wird zwar gefunden, aber nun muss Pedro vor der Polizei flüchten.

Durch das Erlebte weiß Pedro jetzt, wie wichtig ihm vor allem Jackie aber auch Theo geworden sind. Er flüchtet mit den Beiden durch Spanien. Sie kommen in einer „Geisterstadt“ unter, die fast völlig leer steht, nachdem der Immobiliencrash dort die Menschen vertrieben hat. Dass Jackie in Genf ankommt, ist Pedro nun wichtiger, als alles andere. Auf einem spanischen Rastplatz werden sie schlussendlich von der Polizei angehalten aber sie schaffen es irgendwie, bei einem Arzt im Wagen unterzukommen. Dieser arbeitet für die Organisation „Ärzte ohne Grenzen“ und mit ihm gelangen sie auf seinem Rückweg in die Schweiz endlich nach Genf.

Fazit & Kritiken zum Film „Black Brown White“

Die Pointe des Film „Black Brown White“ ist so schön wie simpel. Pedro hat durch das nicht geplante Abenteuer gelernt, dass Menschen wichtiger sind als Geld und das Schicksal von Menschen wichtiger, als auf Profit ausgelegte Wirtschaftssysteme. Erwin Wagenhofer hat einen eindringlichen Film gemacht. Was zunächst wie ein klassisches Roadmovie aussieht, entpuppt sich als Charakter- und Gesellschaftsstudie. Darin steckt definitiv eine Anklage gegenüber der Macht wirtschaftlicher Profitgier. Aber der nicht nur bittere Film zeigt auch ein tiefgehendes Verständnis dafür, wie Menschen ticken. Was einfache Leute antreibt und wie sie ihr Leben in einer schwer überschaubaren Welt meistern.

An manchen Stellen fehlt dem Dokumentarfilmer Wagenhofer jedoch die Erfahrung mit der Gestaltung eines stringenten Spannungsbogens. Die grundsätzlich spannende Geschichte und die Charakterentwicklung des Fernfahrers Pedro werden allzu oft unterbrochen, um den politischen Botschaften des Films fast schon aufdringlich belehrend das Spielfeld zu überlassen. Die tollen Schauspieler gleichen das aber bis zu einem gewissen Grad wieder aus. Und durch die intensive und bildhafte Inszenierung des Kameramanns Martin Gschlacht ist der Film zu jeder Zeit ein Fest fürs Auge.